Time Horizon Compared with buyers, traders have a short-expression time horizon in mind though executing their trades. Which is mainly because traders keep track of the markets consistently for adjustments in asset charges before making their moves.

Consequently, it is actually critical to have very clear targets in your mind, then be certain your trading system is capable of accomplishing these targets. Every trading type has another risk profile, which requires a certain Mindset and method of trade effectively.

The Bottom Line Currency risk won't only influence organizations and international investors. Modifications in currency rates around the world bring about ripple outcomes that impression industry members through the entire globe.

Day trading just some hours on a daily basis can present you with a lot of independence, so as compared to Functioning a 9 to 5 job, you might have a good amount of time to invest with your family, buddies or performing the stuff you like the most.

Risk Tolerance and Investment Goals Step one in pinpointing the suitability of any financial commitment product should be to assess risk tolerance. This can be the ability and want to take on risk in return for the possibility of increased returns. Even though mutual funds are sometimes thought of among the safer investments out there, specific sorts of mutual funds are not appropriate for those whose most important target is to avoid losses in the slightest degree expenses.

Equally as with all your entry level, define accurately how you'll exit your trades before you enter them. factors affecting foreign exchange rates The exit conditions should be particular more than enough to become repeatable and testable.

Retirement What on earth is Inventory Trading? six min read through Inventory trading is like fishing—All people hopes find more to let you know about the time they caught “the big a person,” but in no way with regards to the types that bought away. Below’s why stock trading is a bad concept! Ramsey Read More

The reverse is also genuine: trading income is often produced by advertising at a greater rate and shopping for to cover in a lower cost (referred to as providing short) to financial gain in slipping marketplaces.

Traders are additional risk-tolerant, so they won't get distracted when there are several dips available in the market or when they turn out using a loss. People who are more risk-averse and want to maintain their capital do much better with investing.

How to deal with Risk When up and operating with actual money, you might want to deal with placement and risk administration. Just about every situation carries a learn this here now Keeping period of time and specialized parameters that favor financial gain and reduction targets, requiring your well timed exit when arrived at.

Initially, know that you are going up against experts whose careers revolve all over trading. These individuals have usage of the best engineering and connections while in the marketplace. Meaning They are setup to succeed ultimately. If you bounce about the bandwagon, it always suggests much more profits for them.

Here's an example of a trade with RRR below 1, a trade most profitable traders would dismiss. The set up for this trade breakout of a chart pattern.

The S&P five hundred® Index can be a industry capitalization-weighted index of 500 widespread stocks directory decided on for industry dimension, liquidity, and sector group illustration to stand for US fairness overall performance.

Liquidity. A safety which is liquid helps you learn this here now to buy and market it very easily, and, ideally, at a very good cost. Liquidity is a bonus with limited spreads, or the difference between the bid and request price of a inventory, and for low slippage, or the difference between the predicted price of a trade and the particular cost.

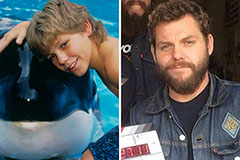

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Brandy Then & Now!

Brandy Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!